Landlords undeniably need protection insurance to safeguard their investments against financial risks. This insurance serves as a crucial safety net during tenant disputes, unexpected property damage, and rent defaults. It preserves cash flow and enhances financial security, allowing landlords to focus on property improvement rather than potential pitfalls. By understanding the different types of coverage and their benefits, landlords can make informed decisions to protect their assets effectively. Further exploration reveals key factors for selecting the right insurance.

Key Takeaways

- Protection insurance safeguards landlords’ investments against financial pitfalls and unexpected challenges, ensuring long-term stability.

- It provides peace of mind, allowing landlords to focus on enhancing their properties without constant worry.

- Coverage types like landlord liability and rent guarantee insurance address specific risks associated with property management.

- Insurance minimizes financial strain from tenant disputes, property damage, or legal issues, preserving cash flow.

- Evaluating premium costs and coverage limits helps landlords make informed decisions tailored to their unique circumstances.

Understanding the Importance of Protection Insurance for Landlords

While many landlords prioritize maximizing their rental income, understanding the importance of protection insurance is essential for safeguarding their investments. This type of insurance offers a vital safety net against potential financial pitfalls, particularly in the face of tenant disputes. Disagreements can arise unexpectedly, leading to costly legal battles or prolonged vacancies. By securing protection insurance, landlords can guarantee financial security, allowing them to navigate these challenges with confidence. Furthermore, this insurance not only mitigates risks but also provides peace of mind, enabling landlords to focus on enhancing their properties rather than worrying about unforeseen issues. Ultimately, investing in protection insurance is a proactive step toward preserving both income and property value in an uncertain rental market. Additionally, landlords may benefit from hiring professional investigators to gather evidence in case of disputes with tenants.

Types of Protection Insurance Available

Protection insurance for landlords encompasses various types designed to address specific risks and challenges associated with rental properties. One key type is landlord liability insurance, which protects against claims arising from tenant injuries or property damage. Another essential option is rent guarantee insurance, ensuring that landlords receive rental income even in the event of tenant default. Additionally, property insurance covers damages to the building itself, safeguarding against unforeseen incidents such as fire or vandalism. Each type of protection serves a distinct purpose, creating a safety net that not only secures financial interests but also instills peace of mind. By understanding these options, landlords can make informed decisions to protect their investments and foster a successful rental experience. Furthermore, landlords may also benefit from investigative services to ensure tenant reliability and safety.

Benefits of Having Protection Insurance

Having protection insurance provides landlords with an essential financial safeguard that minimizes risks associated with property management. This type of insurance offers invaluable financial security by covering potential losses due to tenant defaults, property damage, or legal disputes. With robust risk management strategies in place, landlords can navigate the turbulent waters of property ownership with greater confidence. Protection insurance not only mitigates unforeseen expenses but also preserves cash flow, enabling landlords to focus on enhancing their properties and relationships with tenants. Additionally, the peace of mind that comes with knowing one is protected against various liabilities fosters a more stable investment environment. Overall, protection insurance is a prudent choice for landlords seeking to secure their financial future and effectively manage risks. Moreover, understanding the importance of insurance fraud prevention can further benefit landlords by protecting their investments from fraudulent claims.

Factors to Consider When Choosing Coverage

What key factors should landlords consider when selecting coverage for their properties? First, premium costs must be carefully examined, as they directly impact a landlord’s financial viability. A balance between affordable premiums and thorough coverage is essential. Next, coverage limits should align with the property’s value and potential liabilities; inadequate limits could leave landlords financially vulnerable. Additionally, evaluating the specific risks associated with the property, such as location and tenant demographics, can guide more tailored coverage options. Landlords should also review the insurer’s reputation and claims process efficiency, ensuring they choose a provider that offers support when needed. Ultimately, informed decisions regarding premium costs and coverage limits can safeguard landlords against unforeseen challenges. Furthermore, understanding the importance of pre-employment background checks can help landlords select trustworthy tenants and reduce potential risks associated with rental properties.

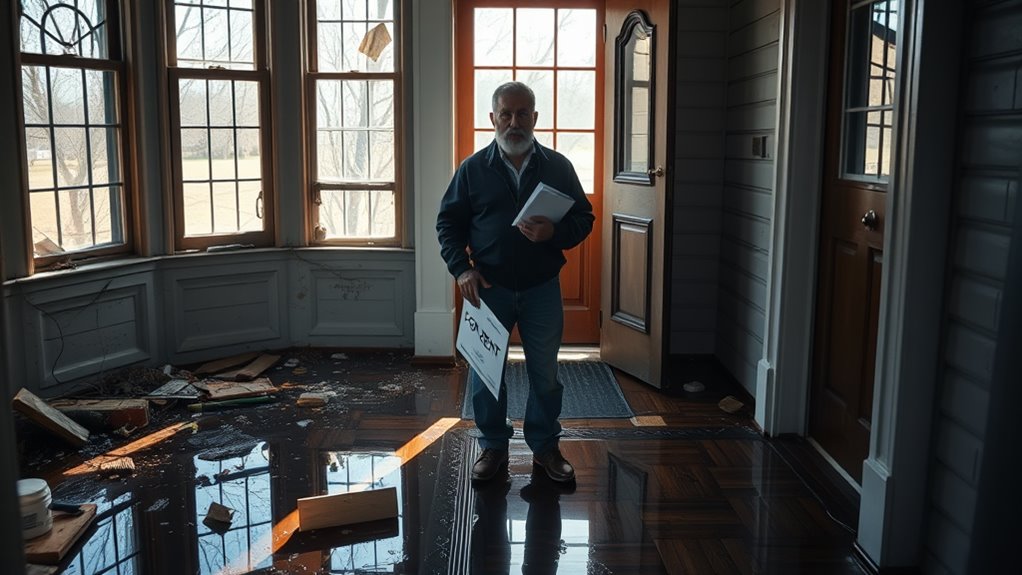

Real-Life Scenarios: When Protection Insurance Can Save You

How can landlords effectively navigate the uncertainties of property management? Real-life scenarios illustrate the necessity of protection insurance in mitigating risks. Consider a landlord facing a tenant dispute over unpaid rent. Without protection insurance, legal fees and lost income can swiftly accumulate, creating financial strain. Similarly, a sudden incident leading to property damage—such as a fire or vandalism—can leave landlords vulnerable to substantial repair costs. Insurance can cover these unexpected expenses, allowing landlords to focus on maintaining their properties rather than scrambling for funds. By investing in protection insurance, landlords secure a safety net, ensuring peace of mind during challenging times. Ultimately, this proactive approach transforms potential pitfalls into manageable hurdles, fostering a more stable rental experience. Furthermore, having protection insurance can provide landlords with valuable evidence sourcing that may be essential in resolving disputes or filing claims.

Frequently Asked Questions

What Is the Cost of Landlord Protection Insurance?

The cost of landlord protection insurance varies considerably, influenced by cost factors such as property location, coverage limits, and tenant history. Premium rates typically range from affordable to high, reflecting the risks involved in property management.

How Do I File a Claim for Protection Insurance?

Filing a claim for protection insurance involves understanding the claim process thoroughly. Essential steps include gathering all relevant insurance documentation and submitting it promptly, ensuring clarity and completeness to facilitate a smooth resolution and timely compensation.

Are There Exclusions in Landlord Protection Insurance Policies?

Exclusions in landlord protection insurance policies often include specific instances such as intentional damage or regular wear. Understanding these exclusions explained alongside policy limitations is essential for landlords to guarantee thorough coverage and informed decision-making.

Can I Get Coverage for Short-Term Rentals?

Short-term coverage is available for rental risks, offering landlords protection against potential liabilities. However, policies may vary, necessitating careful evaluation to guarantee adequate coverage aligns with specific short-term rental needs and potential exposures.

How Often Should I Review My Protection Insurance Policy?

Regular policy frequency reviews are essential for ideal coverage assessment. Experts recommend evaluating insurance annually, ensuring that protection aligns with changing needs and market conditions, thereby safeguarding assets and enhancing overall financial security for property owners.

Conclusion

In summary, protection insurance is not merely an option for landlords but an essential safeguard against potential financial pitfalls. By understanding the various types of coverage available and weighing the benefits, landlords can make informed decisions tailored to their specific needs. The unpredictable nature of rental properties underscores the importance of having adequate protection in place. Ultimately, investing in protection insurance can provide peace of mind and financial security, ensuring landlords can focus on their investments without undue stress.