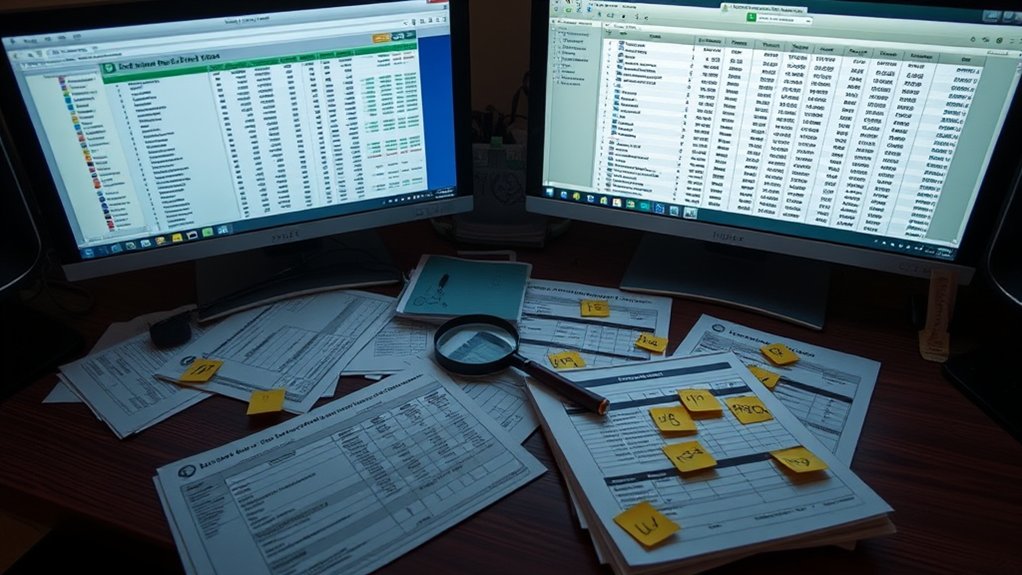

Private investigators track hidden assets through systematic analysis of public records, financial documents, and digital footprints. They examine courthouse filings, property records, and corporate registrations while monitoring lifestyle patterns and social media activity. Advanced database subscriptions enable cross-referencing of information across jurisdictions. Professional surveillance techniques document discrepancies between declared assets and actual expenditures. The investigation process reveals complex networks of concealed wealth through multiple interconnected methods.

Key Takeaways

- Private investigators analyze public records, including court documents, property assessments, and business registrations to uncover concealed assets.

- Digital footprint examination of social media, e-commerce transactions, and electronic payments reveals discrepancies between declared assets

Public Records and Database Investigation

When conducting asset investigations, public records and database searches serve as fundamental starting points for uncovering hidden property, financial accounts, and business interests. Investigators systematically access courthouse records, property assessments, tax filings, and business registrations through specialized online databases designed for professional research.

These searches often reveal interconnected networks of information, including property transfers, liens, judgments, and corporate affiliations. By cross-referencing multiple public records, investigators can identify patterns and relationships that point to concealed assets. The process requires meticulous attention to detail, as valuable information may be buried within seemingly unrelated documents. Professional database subscriptions provide investigators with thorough tools to aggregate and analyze data from various jurisdictions, enabling them to build compelling evidence of hidden asset ownership.

With over 17 years experience in fraud investigations, these methods have proven essential for detecting concealed assets across insurance fraud cases.

Digital Footprint Analysis

In today’s interconnected world, digital footprint analysis provides investigators with powerful methods to trace hidden assets through subjects’ online activities and electronic records. By examining social media profiles, investigators can identify patterns in online behavior that reveal undisclosed properties, business interests, or luxury purchases.

Digital traces extend beyond obvious platforms to include e-commerce transactions, travel bookings, and subscription services that may expose financial activities. Investigators analyze metadata from digital photos, which often contain location data and timestamps that can link subjects to specific properties or assets. Electronic payment records, mobile app usage, and digital communications create thorough data trails that skilled investigators can follow to uncover hidden wealth. This digital detective work often reveals inconsistencies between declared assets and actual lifestyle patterns. Modern TSCM equipment helps detect any surveillance devices that might compromise sensitive financial investigations.

Lifestyle Assessment and Surveillance

Observation of a subject’s daily routines and spending patterns serves as an essential investigative method for identifying hidden assets. Private investigators systematically document lifestyle habits, including frequent visits to exclusive establishments, luxury purchases, and high-end recreational activities that may indicate undisclosed wealth. This surveillance extends to monitoring social behaviors at country clubs, upscale restaurants, and private events.

Investigators analyze discrepancies between reported income and observed expenditures, noting vehicle ownership, property maintenance, domestic staff, and travel patterns. They document regular activities through photography, video recordings, and detailed logs. The compilation of this lifestyle data creates a thorough profile that can reveal inconsistencies between declared financial status and actual living standards, often providing vital evidence for asset investigations. Their work is strengthened through digital forensics services that can recover data from electronic devices to uncover additional financial trails.

Bank Account and Financial Document Review

A thorough review of bank statements, financial records, and transaction histories forms the foundation of asset investigation. Investigators conduct extensive financial audits to identify patterns, discrepancies, and potential hidden assets. Through systematic document analysis, investigators examine deposit records, wire transfers, and recurring transactions. Similar to background check compliance, investigators must obtain proper consent and follow legal regulations when accessing financial records.

| Document Type | Review Focus | Key Indicators |

|---|---|---|

| Bank Statements | Cash Flow | Large Deposits |

| Credit Reports | Debt Profile | New Accounts |

| Tax Returns | Income Sources | Unreported Earnings |

| Property Records | Asset Ownership | Recent Transfers |

| Investment Documents | Portfolio Activity | Hidden Holdings |

This methodical examination reveals financial behaviors, relationships between accounts, and possible asset concealment strategies. Investigators cross-reference information across multiple financial institutions and documentation types to construct a complete picture of an individual’s financial position and identify potentially hidden resources.

Property and Real Estate Research

Property and real estate investigations extend beyond traditional financial documentation to uncover tangible assets that may be concealed through complex ownership structures. Investigators meticulously search public records, including deed registries, tax assessments, and property transfers, to identify potential hidden holdings.

Comprehensive research includes analyzing real estate appraisal records, examining property ownership histories, and investigating shell companies or trusts that might obscure true ownership. Investigators cross-reference addresses, monitor recent transactions, and evaluate property valuations against market norms to detect irregularities.

The process often reveals patterns of asset movement through thorough examination of county records, building permits, and zoning applications. Professional investigators may also conduct physical surveillance of properties and interview neighbors to gather additional evidence of ownership or occupancy. Private investigators’ expertise ensures accurate verification and detailed reporting of findings to reduce potential liability risks for clients.

Business Entity and Corporate Connections

Investigating hidden assets requires thorough examination of complex shell company structures and their interconnected relationships across multiple jurisdictions. Corporate paper trails, including formation documents, annual reports, and regulatory filings, can reveal networks of associated business entities and beneficial ownership. Systematic analysis of corporate registries, transaction records, and official business databases helps reconstruct the organizational hierarchy and identify concealed asset transfers between related companies. Forensic accounting techniques are essential for detecting financial irregularities and tracing misappropriated assets through corporate entities.

Examining Shell Company Networks

Shell company analysis requires investigators to meticulously map complex networks of interconnected business entities. By examining incorporation documents, registered agents, and shared addresses, investigators can identify patterns that reveal hidden asset transfers and ownership structures.

Corporate transparency laws have strengthened investigators’ ability to penetrate shell company networks. They systematically analyze annual reports, tax filings, and regulatory disclosures to expose links between seemingly unrelated entities. Key indicators include common directors, overlapping shareholders, and circular ownership arrangements.

Investigators track transaction flows between shell companies, focusing on jurisdictions known for financial secrecy. They cross-reference database records, corporate filings, and public records to construct relationship diagrams that visualize the movement of assets through multiple layers of shell companies, ultimately leading to beneficial owners.

Following Corporate Paper Trails

Successful asset tracking requires investigators to systematically review an extensive array of corporate documentation and public records. Investigators analyze corporate tax records, annual reports, meeting minutes, and regulatory filings to establish clear patterns of financial activity and identify potential asset transfers.

Asset Recovery Techniques

Asset recovery professionals employ systematic bank account surveillance through methods like transaction pattern analysis and account holder verification procedures to trace concealed funds. Property title searches involve examining public records, deed registries, and tax assessments to identify real estate holdings linked to investigated parties. These techniques often work in tandem, with discoveries in banking records potentially revealing property acquisitions and vice versa, creating an extensive trail of hidden assets. Investigators leverage specialized asset locator services to efficiently uncover financial holdings across multiple jurisdictions.

Bank Account Surveillance Methods

When tracking hidden financial assets, bank account surveillance represents one of the most essential investigative methods available to recovery specialists. Through systematic monitoring of financial transactions and account activities, investigators can identify patterns, relationships, and anomalies that reveal concealed assets.

Bank monitoring techniques typically include

Property Title Search Strategies

Property title searches provide critical pathways for uncovering hidden real estate holdings and asset ownership transfers during recovery investigations. Through systematic title deed examination and property valuation methods, investigators can trace ownership patterns and discover concealed assets.

| Search Strategy | Primary Purpose |

|---|---|

| Chain of Title | Track ownership history and transfers |

| Lien Search | Identify financial obligations and creditors |

| Tax Assessment | Determine property values and payment records |

| Deed Analysis | Reveal related parties and transaction details |

Investigators utilize county recorder offices, online databases, and specialized title search platforms to compile detailed property profiles. These searches often reveal patterns of property transfers between related entities, questionable valuations, and strategic timing of transactions that may indicate attempts to shield assets from recovery efforts.

Legal Tools and Court Orders

Legal professionals have access to several powerful court orders and judicial mechanisms designed to uncover hidden assets. These legal strategies include subpoenas to obtain financial records, depositions to question individuals under oath, and court-mandated asset disclosure forms. Asset freeze orders can prevent the transfer or dissipation of assets during investigations.

Discovery orders enable investigators to examine bank statements, tax returns, and business records. Courts may also issue orders compelling third parties, such as banks and employers, to release relevant financial information. In cases of suspected fraudulent transfers, attorneys can pursue fraudulent conveyance actions to void transactions designed to hide assets. Additionally, contempt orders can be obtained against individuals who fail to comply with court-mandated asset disclosures, potentially resulting in severe penalties or incarceration. Private investigators often employ RF signal detection methods to locate hidden electronic devices that may contain evidence of concealed assets.

Frequently Asked Questions

How Much Do Private Investigators Typically Charge for Asset Tracking Services?

Private investigator fees for asset tracking services typically range from $75-250 per hour, with most cases requiring 10-20 hours, though complex investigations may cost several thousand dollars.

Can Private Investigators Legally Access Someone’s Offshore Bank Account Information?

Private investigators cannot legally access offshore banking information directly. International privacy laws protect account details, requiring court orders or legal authority for disclosure through proper banking channels.

What Percentage of Hidden Assets Are Successfully Recovered?

Statistical data on hidden wealth recovery rates varies widely, with success rates ranging from 30-60% in asset division cases, depending on jurisdictional cooperation and sophistication of concealment methods.

How Long Does a Typical Asset Investigation Take to Complete?

Asset investigations typically span 2-4 weeks for basic cases, while complex asset discovery involving multiple jurisdictions and shell companies can extend 3-6 months or longer, depending on investigation timeline complexities.

Do Private Investigators Need Special Certifications for Financial Investigations?

Certification requirements vary by jurisdiction, with many investigators obtaining specialized training in financial investigative techniques. Professional licenses, accounting credentials, and fraud examination certifications enhance expertise in financial investigations.

Conclusion

Private investigators employ multiple sophisticated methods to uncover hidden assets, combining traditional investigative techniques with modern digital tools. Through systematic analysis of public records, financial documents, digital footprints, and business connections, they build thorough asset profiles. When supported by legal mechanisms and court orders, these methodical approaches enable investigators to trace and document concealed wealth effectively, providing valuable evidence for their clients.