Private investigators handling alimony noncompliance cases must operate within strict legal parameters while gathering evidence. Key requirements include maintaining detailed documentation of financial records, conducting surveillance within privacy laws, and employing digital forensics to track assets. Investigators analyze lifestyle indicators, examine bank statements, and monitor electronic transactions to uncover hidden income. Professional ethics and proper chain of custody procedures guarantee evidence remains legally admissible. These foundational guidelines lead to more thorough investigative strategies.

Key Takeaways

- Maintain detailed financial surveillance records including bank statements, tax returns, and lifestyle indicators to document potential alimony payment violations.

- Document all surveillance activities with precise timestamps, locations, and observations while strictly adhering to privacy laws and jurisdictional regulations.

- Analyze digital footprints through social media monitoring, electronic payments, and online marketplace activities to uncover concealed income sources.

- Create comprehensive documentation of unexplained deposits, unusual spending patterns, and hidden assets through structured financial analysis techniques.

- Ensure all evidence collection methods comply with federal and state laws while maintaining proper chain of custody for legal admissibility.

Legal Parameters and Boundaries for Alimony Investigations

When conducting alimony investigations, private investigators must operate within strict legal boundaries established by federal and state laws governing surveillance, privacy rights, and evidence collection. These parameters guarantee that gathered evidence remains admissible in court while protecting the rights of all parties involved.

Investigators need to maintain awareness of jurisdictional variances in surveillance laws, particularly regarding recording devices, trespassing restrictions, and consent requirements. Legal compliance demands thorough documentation of investigative methods, maintaining proper licensing, and adhering to state-specific regulations for private investigators. Activities must avoid harassment, stalking, or invasion of privacy that could result in civil or criminal penalties. Understanding these boundaries helps investigators build credible cases while fostering trust with clients and maintaining professional integrity within the legal system. Leveraging forensic accounting services enables investigators to meticulously track financial discrepancies and uncover hidden assets that may impact alimony compliance.

Documentation Requirements and Evidence Collection Standards

Private investigators must maintain meticulous documentation standards when gathering evidence for alimony cases, including detailed financial records analysis, surveillance logs, and properly authenticated digital materials. The systematic collection of evidence requires adherence to strict protocols for photographing subjects, recording timestamps, maintaining chain of custody records, and preserving the integrity of gathered materials. Professional investigators follow established best practices for organizing and submitting evidence packages to attorneys, ensuring all materials meet legal admissibility requirements and can withstand scrutiny in court proceedings. Evidence gathering becomes especially critical in fault-based divorce situations where proper documentation can significantly impact financial settlements and support obligations.

Financial Records Analysis Steps

Analyzing financial records in alimony investigations requires strict adherence to documentation protocols and chain-of-custody standards. Investigators must systematically examine bank statements, tax returns, investment accounts, and business records to identify potential financial discrepancies that may indicate hidden income or assets.

The process involves implementing structured analysis techniques, including cross-referencing financial documents with lifestyle indicators, examining recurring transactions, and tracking cash flow patterns. Investigators document their findings through detailed spreadsheets, maintaining chronological records of all transactions flagged for further review. They also note any unexplained deposits, unusual spending patterns, or transfers between accounts that could suggest attempts to conceal income. Each finding must be thoroughly documented with supporting evidence to guarantee admissibility in legal proceedings.

Surveillance Methods and Rules

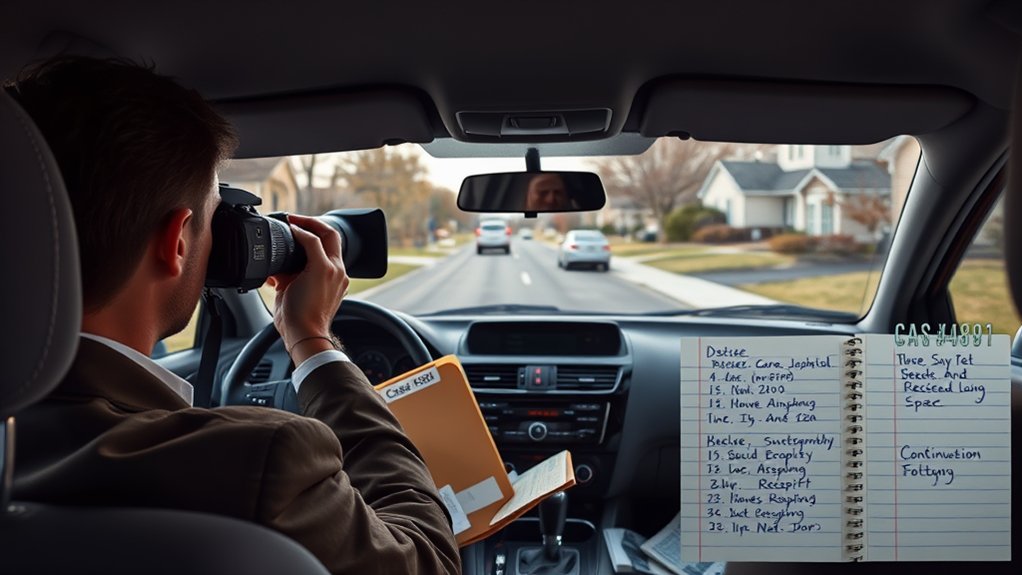

Surveillance operations in alimony investigations must follow strict documentation protocols to guarantee evidence admissibility in court proceedings. Investigators maintain detailed logs recording dates, times, locations, and observed activities, while preserving photographic and video evidence through secure digital storage systems.

During covert operations, investigators must balance ethical dilemmas with professional responsibilities. They adhere to state-specific privacy laws, avoid trespassing, and maintain appropriate distances when documenting subject activities. All surveillance methods strictly prohibit harassment or interference with the subject’s daily routines.

Documentation requirements include standardized forms, continuous chain of custody records, and verification of equipment calibration. Investigators catalog all evidence chronologically, cross-reference multiple sources, and prepare detailed reports that withstand legal scrutiny while protecting both client interests and subject privacy rights.

Evidence Submission Best Practices

Legal admissibility of evidence in alimony cases requires investigators to follow systematic collection and submission protocols. Each piece of evidence must be properly documented with date, time, location, and methodology used to obtain it. Investigators must maintain evidence integrity through secure storage and unbroken chain of custody records.

Documentation requirements include detailed field notes, properly labeled photographs and videos, and authenticated digital records. All surveillance logs must specify the equipment used, weather conditions, and any potential limitations or obstructions encountered. When submitting evidence, investigators should organize materials chronologically and include cross-referenced indexes for easy retrieval. Submission protocols require evidence to be presented in both physical and digital formats when applicable, with backup copies secured offsite. All materials must comply with state-specific legal requirements for admissibility in court proceedings.

Digital Forensics and Financial Tracking Methods

Private investigators employ digital forensics and financial tracking methods to uncover evidence of hidden assets or undisclosed income in alimony cases. While respecting digital privacy laws, investigators utilize specialized forensic tools to analyze financial records, social media activity, and electronic communications. These methods help establish patterns of unreported income or lifestyle inconsistencies.

| Method | Application | Evidence Type |

|---|---|---|

| Data Recovery | Deleted Files | Financial Records |

| Network Analysis | Online Activity | Transaction History |

| Cloud Forensics | Digital Storage | Asset Documentation |

| Social Mining | Public Posts | Lifestyle Indicators |

Modern financial tracking combines traditional surveillance with digital investigation techniques. Investigators monitor electronic payment systems, cryptocurrency transactions, and banking patterns while maintaining proper chain of custody for all collected evidence. This extensive approach guarantees thorough documentation of potential alimony violations while adhering to legal standards.

Licensed investigators ensure evidence gathered through digital tracking is admissible and authoritative for court proceedings.

Surveillance Techniques for Lifestyle Analysis

Beyond digital investigations, lifestyle analysis through physical surveillance serves as a fundamental component in alimony cases. Professional investigators employ systematic observation methods to document lifestyle discrepancies that may indicate unreported income or deceptive financial claims.

Behavioral patterns are documented through strategic mobile surveillance, including monitoring shopping habits, dining experiences, and recreational activities. Investigators track vehicle movements, photograph visible assets, and observe social interactions that could reveal undisclosed relationships or employment. Documentation focuses on establishing regular patterns rather than isolated incidents.

Field operatives maintain detailed logs of observed activities, noting timestamps, locations, and relevant interactions. This methodical approach creates a thorough timeline of the subject’s actual lifestyle, providing courts with concrete evidence to evaluate support obligations and potential modifications.

Similar to uncovering infidelity cases, investigators maintain strict confidentiality throughout surveillance operations to protect client interests and case integrity.

Asset Discovery and Income Verification Strategies

When conducting asset discovery in alimony investigations, professional investigators employ multiple verification methods to uncover concealed financial resources and income streams. Through systematic asset tracing and thorough income assessment procedures, investigators gather evidence of financial activity that may affect alimony obligations. Independent verification ensures accurate documentation of financial findings and strengthens evidence admissibility in court proceedings.

- Analysis of public records, including property deeds, business licenses, and tax assessments

- Review of financial documents, such as bank statements, credit reports, and investment portfolios

- Investigation of business interests, partnerships, and corporate entities

- Examination of lifestyle indicators, including purchases, travel, and entertainment expenses

- Monitoring of digital footprints through social media and online marketplace activities

These methodical approaches help investigators construct an accurate picture of financial status while maintaining compliance with legal standards and privacy regulations.

Professional Ethics and Client Communication Protocols

The rigorous nature of asset discovery and financial investigations must be balanced with strict adherence to professional ethics and clear client communication standards. Private investigators must maintain detailed documentation of all interactions while upholding client confidentiality throughout the investigation process.

Professional protocols require investigators to establish clear boundaries with clients, provide regular status updates, and maintain transparency regarding investigative methods and limitations. Ethical considerations dictate that all evidence gathering must comply with local laws and regulations, avoiding any form of misrepresentation or illegal surveillance. Investigators should also document all client communications, including scope changes and authorization requests, to protect both parties’ interests. Written agreements should outline service parameters, fee structures, and expected timelines while emphasizing the commitment to legal and ethical investigative practices. Cybersecurity best practices must be implemented to protect sensitive client data through encryption and multi-factor authentication systems.

Frequently Asked Questions

How Long Does It Typically Take to Complete an Alimony Noncompliance Investigation?

Investigation timelines for alimony noncompliance typically range from two to eight weeks, depending on case complexity, evidence gathering requirements, documentation review processes, and subject surveillance patterns.

What Percentage of Alimony Noncompliance Cases Are Successfully Resolved?

Studies indicate that 65-75% of alimony noncompliance cases achieve successful resolutions when proper investigation strategies are employed, including surveillance, financial tracking, and thorough documentation of payment patterns.

Can Ex-Spouses Be Notified That They Are Under Investigation?

Due to client confidentiality requirements and the sensitive nature of undercover operations, investigators typically do not notify subjects of surveillance activities, as this would compromise the investigation’s integrity and effectiveness.

Do Private Investigators Need Special Certifications for Alimony Cases?

Private investigators typically require standard state certification requirements and basic investigative training. Specific alimony case certifications aren’t mandatory, though experience in financial surveillance and documentation proves valuable.

What Are the Average Costs for Hiring a PI for Alimony Investigations?

Average investigator fees for alimony cases typically range from $50-150 per hour, with cost breakdown including surveillance time, mileage, equipment expenses, and report preparation. Most cases require 20-40 hours.

Conclusion

Following established guidelines in alimony noncompliance investigations guarantees legal compliance while maximizing effectiveness. Private investigators must maintain meticulous documentation, employ appropriate surveillance methods, and utilize digital forensics within legal boundaries. Success depends on thorough financial tracking, extensive lifestyle analysis, and ethical practices. When these protocols are properly implemented, investigators can provide courts with admissible evidence that supports enforcement of alimony obligations.